N302 Indian Banking System BBA Unit 1st Notes

BBA-III

SEMESTER

N302 Indian Banking System

Objective: The objective is to familiarize the students to

understand the practice and procedure of the Indian banking system.

Unit I

Indian

Banking System: Structure and organization of banks, Reserve Bank of India;

Apex banking institutions; Commercial banks; Regional rural banks; Co-operative

banks; Development banks.

EVOLUTION OF BANKING

As a public initiative, banking completed its commencement in the twelfth century in Italy. The Bank of Venice, originated in 1157, was the first public banking association.1 Following its institution, were recognized the Bank of Barcelona and the bank of Genoa in 1401 and 1407 respectively. The Bank of Venice and the Bank of Genoa continued to work effectively till the completion of the eighteenth century. The word ‘Bank’ is used in the intelligence of a profitable bank. It is of Germanic origin, though some persons smidgen its origin to the French word ‘Banqui’ and the Italian word ‘Banca’. It denoted a bench for keeping, lending, and exchanging of money or coins in the marketplace by money lenders and money changes. 2 Approximately there was no such word as ‘banking’ before 1640, though the training of safe-keeping and investments succeeded in the temple of Babylon as early as 2000 B.C. Chanakya in his Arthashastra written in 300 B.C stated about the survival of powerful unions of commercial bankers who received deposits, advanced loans and hundreds (letters of transfer).The Jain scriptures comment the names of two bankers who built the famous Dilwara temples of Mount Abu during 1197 and 1247 A.D. The bankers of Lombardy were well-known in England. However the modern 40 banking started with the English goldsmiths only after 1640.The Bank of England started its business in 1694 with a view to investment the Government to transfer on its war with France.3

Definition of Banking

The bank is an institution that deals with money.

Banks accept deposits and make loans and derive a profit from the difference in

the interest rates paid and charged, respectively moreover it provides other

financial services

Overview of Indian Banking Sector

A bank is a financial institution that provides banking and other financial services to

their customers.

A bank is generally understood as an institution that provides fundamental banking services such as accepting deposits and providing loans.

There are also

nonbanking institutions that provide certain banking services without meeting

the legal definition of a bank. Banks are a subset of the financial services

industry.

Banking in

India originated in the last decades of the 18th century. The first banks were

The General Bank of India, which started in 1786, and Bank of Hindustan, which

started in 1790; both now vanish. The oldest bank in existence in India

is the State Bank of India, which originated in the Bank of Calcutta in June

1806, which almost immediately became the Bank of Bengal. This was one of the

three presidency banks, the other two being the Bank of Bombay and the Bank of

Madras, all three of which were established under charters from the British

East India Company. For many years the Presidency banks acted as quasi-central

banks, as did their successors. The three banks merged in 1921 to form the

Imperial Bank of India, which, upon India's independence, became the State Bank

of India in 1955

Phases of the evolution of the banking industry:

1-

Early Phase of Indian Banks, from 1786 to 1969

The first bank, namely

Bank of Bombay was established in 1720 in Bombay. Later on, the Bank of Hindustan

was established in Calcutta in 1770. General Bank of India was established in

1786. Bank of Hindustan carried on the business till 1906.

First Joint Stock Bank with limited liability established in India in 1881

was Oudh Commercial Bank Ltd.

East India

Company established

the three independently functioning banks, also known by the name of “Three

Presidency Banks” - The Bank of Bengal in 1806, The Bank of Bombay in 1840, and

Bank of Madras in 1843. These three banks were amalgamated in 1921 and given a

new name as Imperial Bank of India. After Independence, in 1955, the Imperial

Bank of India was given the name "State Bank of India". It was

established under the State Bank of India Act, 1955.

In the surcharged atmosphere of Swadeshi

Movement, a number of private banks with Indian managements had been

established by the businessmen from mid of the 19th century onwards, prominent

among them being Punjab National Bank Ltd., Bank of India Ltd., Canara Bank

Ltd, and Indian Bank Ltd. The first bank with fully Indian management was

Punjab National Bank Ltd. established on 19 May 1894, in Lahore (now in

Pakistan).

2.

Nationalization of Banks and the Banking Sector Reforms, from 1969 to 1991:

The number of

banks in India in 1951 was the highest – 566. In 1960, RBI was empowered to

force the compulsory merger of the weak banks with the strong ones. This led to

a reduction in the number of banks to 89 in 1969.

On July 19, 1969, 14

major banks were nationalized.

On April 15,

1980, another six banks were nationalized and thus raising the number of

nationalized banks to 20.

3.

New Phase of Indian Banking System, with the Reforms After 1991:

On the suggestions of Narasimha Committee, the

Banking Regulation Act was amended in 1993 and thus the gates for the new

private sector banks were opened.

In 1993, the New Bank of India was merged with

Punjab National Bank. “Industrial Development Bank of India (IDBI)” - was

established as a Development Bank in 1964 - by an act of Parliament. It was

given the status of a scheduled bank in September 2004 by RBI.

Bharatiya Mahila Bank Ltd – all women’s bank was established in 2013. It is

based in New Delhi. Its first branch started its operations on November 19,

2013. The inauguration was done by former Indian Prime Minister S. Manmohan

Singh

Indian Banking System:

The present structure of Indian

Banking System

The structure of banking system differs from country to

country depending upon their economic conditions, political structure, and

financial system.

Structure of

Indian Banking As per Section 5(b) of the Banking Regulation Act 1949, the existing banking structure in India evolved over several

decades is elaborate and has been serving the credit and banking services

needs of the economy.

There are multiple layers in today’s banking structure to

cater to the specific and varied requirements of different customers and

borrowers.

The structure of

banking in India played a major role in the mobilization of savings and

promoting economic development.

The Indian banking industry has been divided into

two parts, organized and unorganized sectors. The organized sector consists of

Reserve Bank of India, Commercial Banks and Cooperative Banks, and Specialized

Financial Institutions (IDBI, ICICI, IFC etc).

Structure of

Banks in India:

1-Scheduled Banks

Scheduled

banks are included in the second schedule of the RBI under of the RBI Act 1934.

Every scheduled bank must have a paid-up capital and reserves of an aggregate

value of at least Rs 5 lakhs, and satisfying the Reserve Bank that its affairs

are not being conducted in a manner prejudicial to the interests of its

depositors.

Non-Scheduled

Banks are those banks which are not included under of the RBI act 1934, and not

able to fulfill the criteria of this act.

Scheduled banks are further classified into

commercial and cooperative banks.

The commercial banks can be broadly

classified under two heads:

1. Scheduled Banks:

Scheduled Banks refer to those banks which

have been included in the Second Schedule of Reserve Bank of India Act, 1934.

In India, scheduled commercial banks are of

three types:

(i) Public Sector Banks:

These banks are owned and controlled by the

government. The main objective of these banks is to provide service to the

society, not to make profits. State Bank of India, Bank of India, Punjab

National Bank, Canada Bank, and Corporation Bank are some examples of public

sector banks.

Public sector banks are of two types:

(a) SBI and its subsidiaries;

(b) Other nationalized banks.

(ii) Private Sector Banks:

These banks are owned and controlled by

private businessmen. Their main objective is to earn profits. ICICI Bank, HDFC

Bank, IDBI Bank is some examples of private sector banks.

(iii) Foreign Banks:

These banks are owned and controlled by

foreign promoters. Their number has grown rapidly since 1991 when the process

of economic liberalization had started in India. Bank of America, American

Express Bank, Standard Chartered Bank are examples of foreign banks.

2. Non-Scheduled Banks:

Non-Scheduled banks refer to those banks

which are not included in the Second Schedule of Reserve Bank of India Act,

1934.

Commercial

banks are of (3) Three Types:

(a) Public Sector Banks:

Refer to a type of commercial banks that are

nationalized by the government of a country. In public sector banks, the major

stake is held by the government. In India, public sector banks operate under

the guidelines of the Reserve Bank of India (RBI), which is the central bank. Some

of the Indian public sector banks are State Bank of India (SBI), Corporation

Bank, Bank of Baroda, Dena Bank, and Punjab National Bank.

(b) Private Sector Banks:

Refer to a kind of commercial bank in which a major part of share capital is held by private businesses and individuals.

These banks are registered as companies with limited liability. Some of the

Indian private sector banks are Vysya Bank, Industrial Credit, and Investment

Corporation of India (ICICI) Bank, and Housing Development Finance Corporation

(HDFC) Bank.

(c) Foreign Banks:

Refer to commercial banks that are

headquartered in a foreign country, but operate branches in different

countries. Some of the foreign banks operating in India are Hong Kong and

Shanghai Banking Corporation (HSBC), Citibank, American Express Bank, Standard

& Chartered Bank, and Grindlay’s Bank. In India, since financial reforms of

1991, there is a rapid increase in the number of foreign banks. Commercial

banks mark significant importance in the economic development of a country as

well as serving the financial requirements of the general public.

Private Sector banks: Private sector banks continued to

operate in the banking sector after the nationalization of 20 banks in 1969 &

1980. According to a new policy framed in January 1993 by RBI new banks were formed

in the private sector. Such as

Sources

of funds for a bank

A bank is

a business firm. Its main aim is to earn a profit. In order to achieve this

objective, it provides services to customers. It offers a variety of

interest-bearing obligations to the public. These obligations are the sources

of funds for the bank and are shown on the liability side of the balance sheet

of a commercial bank.

The main sources which supply funds to a bank

are as follows:

A Bank‘s

Own Funds.

B Borrowed

Funds.

1. Bank’s

own funds. Bank‘s own funds are mainly of three types;

(a) Paid-up capital,

(b)

Reserve fund and

(c) A portion of the undistributed profit.

(a) Bank‘s own paid-up capital-The amount

with which a banking company is registered is called nominal or authorized

capital. It is the maximum amount of capital that is mentioned in the capital

clause of the memorandum of association of the company. Capital is further

divided into (i) paid-up capital and (ii) subscribed capital.

(b). Reserve fund. Reserve is another

source of fund which is maintained by all commercial banks. At the time of

declaring a dividend, a certain portion of the profit is transferred to the

reserve fund. This reserve belongs to the .shareholdersand at the time of

liquidation, the Shareholders are entitled to these reserves along with the

capital. The main purpose of setting aside part of the profit is to meet the unforeseen

expenses of the bank. The Banking Companies Ordinance has made it obligatory

(binding) for every banking company incorporated in Pakistan to create a

reserve fund.

(c). Profit. Profit is another source

to a bank for the purpose of business. Profits signify the credit balance of

the profit and loss account which has not been distributed. The accumulated

profits over the years increase the working capital of the bank and strengthen its financial position.

(B) Borrowed Funds.The

borrowed capital is a major and important source of funds for any banking

business. It mainly comes from deposits that are accepted on varying terms in

different accounts. Bank‘s borrowing is mostly in the form of deposits. Bank

collects three kinds of deposits from its customers

(1)

current or demand deposits

(2) saving deposits and

(3) fixed

or time deposits. The larger the deposits of the bank, the larger will be it's (use)

fund for employment and so higher is its profit.

1. Borrowing from central bank.-The

commercial banks in times of emergency borrow loans from the central bank of

the country. The central bank extends help as and when financial help is

required by the commercial banks.

2. Other sources-Bank also

raise funds by issuing bonds, debentures, cash certificates, etc. etc. Though it

is not common but is a dependable source of borrowing.

3. Deposits-Public deposits are a powerful source of funds to a bank. There are‘ three types of bank deposits

(i)

current deposits

(ii)

saving deposits and

(iii) time

deposits.

Due to the spread of literacy, banking habits and growth in the volume of business

operations, there is a marked increase in deposit money with banks.

Reserve Bank of India apex banking institutions.

Reserve Bank of India is a Central Bank

of India i.e. an apex

Institution of Indian monetary system. According to the RBI act 1934,

Reserve Bank of India established on April 1st, 1935. So, Reserve Bank of India

was set up as the private shareholder’s bank with a paid capital of 5 crores.

Objectives

The primary objectives of RBI are to

supervise and undertake initiatives for the financial sector consisting of

commercial banks, financial institutions and non-banking financial companies

(NBFCs).

Some key initiatives are:

1. Restructuring bank inspections

2. Fortifying the role of statutory auditors in the banking

system

Functions of

the Reserve Bank of India (RBI)

As per the RBI Act 1934, it performs 3 types

of functions as that of any other central bank. They are,

1. Banking Functions

2. Supervisory Functions and

3. Promotional Functions.

The main functions of the RBI are to regulate

the money supply in the country. Moreover, it has been directed to take care of

agriculture, industry, export promotion, etc. The RBI is also responsible for

the maintenance of the external value of the rupee.

1. Banking

Functions:

1. Bank of Issue:

Under section 22 of the Reserve Bank of India

Act, the bank has the sole right to issue banknotes of all denominations. The

distribution of one rupee notes and coins and small coins all over the country

is undertaken by the Reserve Bank as an agent of the Government.

The Reserve Bank has a separate Issue

Department which is entrusted with the issue of currency notes. The assets and

liabilities of the Issue Department are kept separate from those other Banking

Department.

Originally, the assets of the Issue Department

were to consist of not less than two-fifths of gold coin, gold bullion or

sterling securities provided the amount of gold was not less than Rs. 40 crores

in value. The remaining three-fifths of the assets might be held in rupees

coins, Government of India rupee securities, eligible bills of exchange and

promissory notes payable in India.

Due to the exigencies of the Second World War

and the post-war period, these provisions were considerably modified. Since

1957, the Reserve Bank of India is required to maintain gold and foreign

exchange reserves of Rs. 200 crores, of which at least Rs. 115 crores should be

in gold. The system as it exists today is known,-as the minimum reserve system.

2. Banker to Government:

The second important function of the Reserve

Bank of India is to act as a Government banker, agent, and adviser. The Reserve The bank is agent of the Central Government and of all State Governments in India

excepting that of Jammu and Kashmir.

The Reserve Bank has the obligation to

transact Government business, via to keep the cash balances as deposits free of

interest, to receive and to make payments on behalf of the Government, and to

carry out their exchange remittances and other banking operations.

The Reserve Bank of India helps the

Government—both the Union and the States to float new loans and to manage

public debt. The Bank makes ways and means advances to the Governments for 90

days. It makes loans and advances to the States and local authorities. It acts

as an adviser to the Government on all monetary and banking matters.

3. Bankers’ Bank and Lender of the Last

Resort:

The Reserve Bank of India acts as the

banker’s bank. According to the provisions of the Banking Companies Act of

1949, every scheduled bank was required to maintain with the Reserve Bank a cash

balance equivalent to 5% of its demand liabilities and 2 percent of its time

liabilities in India.

By an amendment of 1962, the distinction

between demand and time liabilities was abolished and banks have been asked to

keep cash reserves equal to 3 percent of their aggregate deposit liabilities.

The minimum cash requirements can be changed by the Reserve Bank of India.

The scheduled banks can borrow from the

Reserve Bank of India on the basis of eligible securities or get financial

accommodation in times of need or stringency by rediscounting bills of

exchange. Since commercial banks can always expect the Reserve Bank of India to

come to their help in times of banking crisis the Reserve Bank becomes not only

the banker’s bank but also the lender of the last resort.

4. Controller of Credit:

The Reserve Bank of India is the controller

of credit i.e. it has the power to influence the volume of credit created by

banks in India. It can do so through changing the Bank rate or through open

market operations.

According to the Banking Regulation Act of

1949, the Reserve Bank of India can ask any particular bank or the whole

banking system not to lend to particular groups or persons on the basis of

certain types of securities. Since 1956, selective controls of credit are

increasingly being used by the Reserve Bank.

The Reserve Bank of India is armed with many

more powers to control the Indian money market. Every bank has to get a license

from the Reserve Bank of India to do banking business within India. The license

can be canceled by the Reserve Bank if certain stipulated conditions are not

fulfilled. Every bank will have to get the permission of the Reserve Bank

before it can open a new branch.

Each scheduled bank must send a weekly return

to the Reserve Bank showing in detail, its assets and liabilities. This power

of the Reserve Bank to call for information is also intended to give it

effective control of the credit system. The Reserve Bank has also the power to

inspect the accounts of any commercial bank.

As supreme banking authority in the country,

the Reserve Bank of India, therefore, has the following powers:

1. It holds the cash reserves of all the scheduled banks.

2. It controls the credit operations of banks through

quantitative and qualitative control.

3. It controls the banking system through the system of

licensing, inspection, and calling for information.

4. It acts as the lender of the last resort by providing

re-discount facilities to scheduled banks.

5. Custodian of Foreign Reserve:

It is the responsibility of the Reserve bank

to stabilize the external value of the national currency. The Reserve Bank

keeps gold and foreign currencies as reserves against note issues and also

meets the adverse balance of payments with other counties. It also manages foreign currency in accordance with the controls imposed by the

government.

As far as the external sector is concerned,

the task of the RBI has the following dimensions:

§

To administer

the foreign Exchange Control;

§

To choose

, the exchange rate system and fix or manages the exchange rate between the

rupee and other currencies;

§

To manage

exchange reserves;

§

To interact

or negotiate with the monetary authorities of the Sterling Area, Asian Clearing

Union, and other countries, and with international financial institutions such

as the IMF,

World Bank, and Asian Development Bank.

The RBI is the custodian of the country’s

foreign exchange reserves, id it is vested with the responsibility of managing

the investment and utilization of the reserves in the most advantageous manner.

The RBI achieves this through buying and selling of foreign exchange market,

from and to schedule banks, which, are the authorized dealers in the Indian

foreign exchange market. The Bank manages the investment of reserves in gold

counts abroad and the shares and securities issued by foreign governments and

international banks or financial institutions.

2.

Supervisory Functions

In addition to its traditional central

banking functions, the Reserve Bank has certain non-monetary functions of the

nature of supervision of banks and the promotion of sound banking in India.

The Reserve Bank Act, 1934, and the Banking

Regulation Act, 1949 have given the RBI wide powers of supervision and control

over commercial and co-operative banks, relating to licensing and

establishments, branch expansion, liquidity of their assets, management and

methods of working, amalgamation, reconstruction, and liquidation.

The RBI is authorized to carry out periodical

inspection of the banks and to call for returns and necessary information from

them. The nationalization of 14 major Indian scheduled banks in July 1969 has

imposed new responsibilities on the RBI for directing the growth of banking and

credit policies towards more rapid development of the economy and realization

of certain desired social objectives.

The supervisory functions of the RBI have

helped a great deal in improving the standard of banking in India to develop on

sound lines and to improve the methods of their operation.

3.

Promotional Functions

With economic growth assuming a new urgency

since independence, the range of the Reserve Bank’s functions has steadily

widened. The Bank now performs a variety of developmental and promotional

functions, which, at one time, were regarded as outside the normal scope of

central banking.

The Reserve Bank was asked to promote banking

habit, extend banking facilities to rural and semi-urban areas and establish

and promote new specialized financing agencies. Accordingly, the Reserve Bank

has helped in the setting up of the Industrial Finance Corporation of India and

the State Financial Corporations; it set up the Deposit Insurance Corporation

in 1962, the Unit Trust of India in 1964, the Industrial Development Bank of

India also in 1964, the Agricultural Refinance Corporation of Indian in 1963

and the Industrial Reconstruction Corporation of India in 1972.

These institutions were set up directly or

indirectly by the Reserve Bank to promote saving habit and to mobilize savings,

and to provide industrial finance as well as agricultural finance. As far back

as 1935, the Reserve Bank of India set up the Agricultural Credit Department to

provide agricultural credit. But only since 1951 the Bank’s role in this field

has become extremely important.

The Bank has developed the co-operative

credit movement to encourage saving, to eliminate moneylenders from the

villages and to route its short term credit to agriculture. The RBI has set up

the Agricultural Refinance and Development Corporation to provide long-term

finance to farmers.

Commercial Bank

A commercial bank is a kind of financial institution which

carries all the operations related to deposit and withdrawal of money for the

general public, providing loans for investment, etc. These banks are

profit-making institutions and do business only to make a profit.

The two primary characteristics of a commercial bank are

lending and borrowing. The bank receives deposits and gives money to

various projects to earn interest (profit). The rate of interest that a bank

offers to the depositors is known as the borrowing rate, while the rate at

which banks lends the money is called the lending rate.

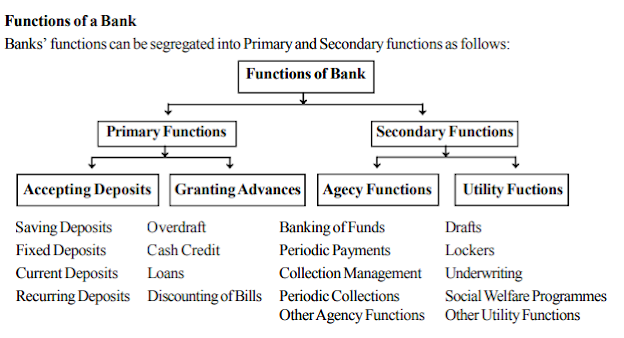

The function of Commercial Bank:

The functions of

commercial banks are classified into two main divisions.

(a) Primary functions –

- Accepts deposit – The bank takes deposits in the form of saving, current, and fixed deposits. The surplus balances collected from the firm and individuals are lent to the temporary required of commercial transactions.

- Provides Loan and Advances – Another critical function of this bank is to offer loans and advances to the entrepreneurs and businesspeople and collect interest. For every bank, it is the primary source of making profits. In this process, a bank retains a small number of deposits as a reserve and offers (lends)

the remaining amount to the borrowers in demand loans, overdraft, cash credit, and short-run loans, etc.

- Credit Cash- When a customer is provided with credit or loan, they are not provided with liquid cash.

First, a bank account is opened for the customer, and then the money is transferred to the account. This process allows a bank to create money.

(b) Secondary functions –

- Discounting bills of exchange – It is a written

agreement acknowledging the amount of money to be paid against the goods

purchased at a given point of time in the future. The amount can also be

cleared before the quoted time through a discounting method of a

commercial bank.

- Overdraft Facility – It is an advance

given to a customer by keeping the current account to overdraw up to the

given limit.

- Purchasing and Selling of the Securities – The bank offers you the facility of selling and buying the securities.

- Locker Facilities – Bank provides lockers facility to the customers to keep their valuable belonging or documents safely. Banks charge a minimum of an annual fee for this service.

- Paying and Gather the Credit – It uses different instruments like a promissory note, cheques, and bill of exchange.

Types of Commercial Bank:

There are three different

types of commercial banks.

- Private Bank – It is one type of commercial banks where

private individuals and businesses own a majority of the share capital.

All private banks are recorded as companies with limited liability. For

example, Bank of Baroda, State Bank of India (SBI), Dena Bank, Corporation

Bank, and Punjab National Bank.

- Public Bank – It is those type of bank that is nationalized,

and the government holds a significant stake. Such as Housing

Development Finance Corporation (HDFC) Bank, Industrial Credit and

Investment Corporation of India (ICICI) Bank, and Vysya Bank, etc.

- Foreign Bank – These banks are established in foreign countries and have branches in other countries. For instance, American Express Bank, Hong

Kong and Shanghai Banking Corporation (HSBC), Standard & Chartered

Bank, and Citibank, etc.

Examples

of Commercial Bank

Few examples of commercial banks in India are.

- State

Bank of India (SBI)

- Housing

Development Finance Corporation (HDFC) Bank

- Industrial

Credit and Investment Corporation of India (ICICI) Bank

- Dena

Bank

- Corporation

Bank

Regional Rural Banks (RRBs)

History of RRBs:

The Regional Rural Banks were set up on the basis of

Narasimhan Committee report (1975), by the legislations of the Regional Rural

Banks Act of 1976. Thereafter, the first Regional Rural Bank was set up in 1975

itself by the name Prathama Grameen Bank.

Ownership of RRBs:

The equity of RRBs is held by the stakeholders in

fixed proportions of 50:15:35 distributed among the following –

- Central The government has a 50% share.

- State The government has a 15% share.

- The

Sponsor Bank has a 35% share.

These ratios are important to remember to be able to

face questions related to regional rural bank recruitment.

Objectives of Regional Rural Banks (RRB):

- To

bridge the credit gap in rural regions in India.

- To

check rural credit outflow to urban areas.

- To

reduce regional imbalances in terms of availability of financial

facilities.

- To

increase rural employment generation.

Characteristic features of RRBs:

- RRBs

have knowledge of rural constraints and problems like a cooperative

because it operates in a familiar rural environment.

- RRBs

show professionalism in mobilizing financial resources like a commercial

bank.

- RRBs

are supposed to work in its prescribed local limits.

- It

provides banking facilities as well as credit to small and marginal farmers, small entrepreneurs, laborers, artisans in rural areas.

- RRBs

have to fulfill the priority sector lending norms as applicable to other commercial banks.

Functions of

Regional Rural Banks

RRBs

do all such functions as are done by domestic banks like accepting deposits

from the public, providing credit, remittance services, etc. They can also invest in

Government securities and deposit schemes of Banks and Financial Institutions.

Regional Rural Banks may also seek to refinance

facilities provided by NABARD for the loans sanctioned and disbursed by them.

All the RRBs are covered under the DICGC scheme

and they are also required to observe the RBI stipulations for Cash Reserve Ratio

and Statutory Liquidity Ratio.

The Reserve bank of India has brought all the

RRBs under the ambit of Priority Sector lending w.e.f April 1997. Like all

other commercial banks, RRB are bound to provide 40% of their Net Bank Credit to

Priority Sector. Out of which 25% of PS advances or 10 % of Net Bank Credit is

to be given to weaker sectors.

Co-Operative Banks of India

§ A Co-operative bank is a financial an entity which belongs to its members, who are at the same time the owners and

the customers of their bank.

§ Co-operative banks in India are

registered under the States Cooperative Societies Act. The

Co-operative banks are also regulated by the Reserve Bank of India

(RBI) and governed by the

o Banking Regulations Act of 1949

o Banking Laws (Co-operative Societies)

Act, 1955.

§ Features of Cooperative Banks:

o Customer Owned Entities: Co-operative bank members are

both customers and owners of the bank.

o Democratic Member Control: Co-operative banks are owned and

controlled by the members, who democratically elect a board of directors.

Members usually have equal voting rights, according to the cooperative

principle of “one person, one vote”.

o Profit Allocation: A significant part of the

yearly profit, benefits or surplus is usually allocated to constitute reserves

and a part of this profit can also be distributed to the co-operative members,

with legal and statutory limitations.

o Financial Inclusion: They have played a significant

role in the financial inclusion of unbanked rural masses.

§ Structure of Cooperative Banking:

§ Advantage of Cooperative Banking

o Cooperative Banking provides an effective alternative to the traditional defective credit system of the village

moneylender.

o It provides cheap credit to masses in

rural areas.

o Cooperative Banks have discouraged

unproductive borrowing personal consumption and have established the

culture of productive borrowing.

o Cooperative credit movement has encouraged

saving and investment, instead of hoarding money the rural people tend

to deposit their savings in the cooperative or other banking institutions.

o Cooperative societies have also

greatly helped in the introduction of better agricultural methods. Cooperative

credit is available for purchasing improved seeds, chemical fertilizers, modern

implements, etc

o Cooperatives Banks offers a higher interest rate on deposits.

§ Problems with Cooperative Banking in

India

o Organizational and financial

limitations of the primary credit societies considerably

reduce their ability to provide adequate credit to the rural population.

· The needs of tenants and small farmers are not fully met.

·

Primary credit societies are financially weak and are unable to meet the

production-oriented credit needs

·

Overdue is increasing alarmingly at all levels.

·

Primary credit societies have not been able to provide adequate and timely

credit to the borrowing farmers.

o The cooperatives have resource

constraints as their owned funds hardly make a sizeable portfolio of the

working capital. Raising working capital has been a major hurdle in their

effective functioning.

o A serious problem of the cooperative

credit is the overdue loans of the cooperative banks which

have been continuously increasing over the years.

·

Large amounts of overdue restrict the recycling of the funds and

adversely affect the lending and borrowing capacity of the cooperative.

o Most of the benefits from the

cooperatives have been covered by the big landowners because

of their strong socio-economic position.

o Cooperative Banks are losing their

luster due to the expansion of Scheduled Commercial Bank and the adoption of

technology. They are also facing stiff competition from payment banks and small finance banks.

o Long-term credit extended by them is

declining.

o Regional Disparities: The cooperatives in northeast

states and in states like West Bengal, Bihar, Odisha are not as well developed

as the ones in Maharashtra and Gujarat. There is a lot of friction due to

competition between different states, this friction affects the working of

cooperatives.

o Political Interference: Politicians use them to

increase their vote bank and usually get their representatives elected over the

board of directors in order to gain undue advantages.

Development Banks

Development banks

are those which have been set up mainly to provide infrastructure facilities

for the industrial growth of the country. They provide financial assistance for

both public and private sector industries.

Objectives of Development Banks

The main objectives

of the development banks are

1. To promote industrial growth,

2. To develop backward areas,

3. To create more employment opportunities,

4. To generate more

exports and encourage import substitution,

5. To encourage modernization

and improvement in technology,

6. To promote more self-employment

projects,

7. To revive sick

units,

8. To improve the

management of large industries by providing training,

9. To remove

regional disparities or regional imbalance,

10. To promote

science and technology in new areas by providing risk capital,

11. To improve the capital market in the country.

Development Banks in India

Working capital

requirements are provided by commercial banks, indigenous bankers, co-operative

banks, money lenders, etc. The money market provides short-term funds which

mean working capital requirements.

The long term

requirements of business concerns are provided by industrial banks and the

various long term lending institutions which are created by the government. In

India these long term lending institutions are collectively referred to as

development banks. They are:

1.

Industrial

Finance Corporation of India (IFCI), 1948

2.

Industrial

Credit and Investment Corporation of India (ICICI), 1955

3.

Industrial

Development of Bank of India (IDBI), 1964

4.

State

Finance Corporation (SFC), 1951

5.

Small

Industries Development Bank of India (SIDBI), 1990

6.

Export

Import Bank (EXIM)

7.

Small

Industries Development Corporation (SIDCO)

8.

National

Bank for Agriculture and Rural Development (NABARD).

In addition to

these institutions, there are also institutions such as Life Insurance

Corporation of India, General Insurance Corporation of India, National Housing

Bank, Unit Trust of India, etc., which are providing investment funds.

Differences between Commercial banks and Development banks

The

following are some of the differences between commercial banks and

development banks.

|

COMMERCIAL

BANKS |

DEVELOPMENT

BANKS |

|

Provide

short term loans. |

Provide

long term loans. |

|

Accept

deposits from the public. |

Accept

deposits from commercial banks, Central and State governments. |

|

Direct finance to customers. |

Provide

refinancing facilities to commercial banks. |

|

Plays an important role in the money

market. |

Play an important role in hiring

purchase, lease

finance, housing

loan. |

|

Public

sector banks have their share capital contributed by the government while private sector banks have share capital contributed by the public. |

Central

and Statement governments contribute to capital. |

|

Promote

savings among the public and help commercial activities. |

They

promote the economic growth of the country

https://www.amazon.in/ref=as_li_ss_tl?ie=UTF8&linkCode=ll2&tag=creative64-21&linkId=bc3502de40ad5dc2f92500fefb9d3d3c&language=en_IN

. |

Copyright @ BN Singh

Page updated

Google Sites

Comments

Post a Comment